- Loans

- Credit card VSEMOZHU Online

- Cash loan VSEYASNO

- Splachuyte chastynamy

- Hroshi v rozstrochku

- Targeted consumer loan

- Online credit

- Credit card VSEMOZHU (till 25.02.2022)

- Deposits

- Deposit Profitable

- Deposit Free

- Deposit Foreign currency

- Deposit Accumulative

- Deposit Guarantee Fund

- Card account

- Card vseKARTA

- vseKARTA for retirement and social payments

- If you're abroad

- Replenish your card abroad

- Promotion Invite a friend

- єВідновлення

- For employees of enterprises

- For entrepreneurs

- Services

- Money transfers

- Currency exchange

- Order cash currency

- MoneyBox

- Insurance products

- Cashback and promo codes

- PUMB mobile app

- Viber-bank in Your pocket

- Google Pay

- Apple Pay

- Swatch Pay

- Xiaomi Pay

- Garmin Pay

- Payment acceptance of individuals

- Transactions with securities

- Depository services

- Personal safes

- Souvenir coins

- Encashment

- Mastercard Bilshe program

- Payment with escrow account

- Card payment Online

- Referral programs

- Invite a friend

- Invite an individual entrepreneur or legal entity

- Accounts and Payments

- Tariff packages

- "Nezlamnyi biznes" package

- "vseDigital Business" package

- Cards

- Pay off

- Pay off the salary

- Transfer entrepreneur's income

- Deposits

- “Comfortable” deposit

- "Standart with replenishment" deposit

- "Flexible" deposit

- The account “Profitable”

- "Standard" deposit

- Loyalty program

- Referral program

- Promos with partners

- Documentary operations

- Letters of credit

- Bank guarantees

- Documentary collection

- Services

- FUIB Terminal

- Currency trading

- Currency advisor

- Transactions with securities

- Depository services

- Internet acquiring

- Тrade acquiring

- Financing

- Affordable loans 5-7-9%

- General credit limit

- Partnership programs

- Bills of exchange for agribusiness

- Factoring

- Financial leasing

- "Light" overdraft

- AutoOver

- Loan secured by deposit

- Financing the restoration of energy infrastructure

- Accounts and Payments

- Tariff packages

- "vseDigital for NPE" package

- “Coder” package

- "Nezlamnyi biznes" package

- Cards

- Pay off

- Accept the payment

- Pay off the salary

- Transfer entrepreneur's income

- Services

- Currency consultations

- Currency trading

- Fast track

- Loyalty program

- Тrade acquiring

- Loyalty program

- Referral program

- Promos with partners

- Financing

- Online loan «VseBUSINESS»

- Overdraft for individual entrepreneurs

- Personal Banking

- Comfortable travels

- Money saving and multiplying

- Family

- About the Bank

- Branches

- Services

- Online financial management

- Investment opportunities

- Products

- Card packages

- Deposits

- Currency transactions

- Individual safes

- Information for shareholders and stakeholders

- Compliance and corporate ethics

- General meeting of shareholders

- Supervisory Board

- Management Board

- Internal Audit Department

- Committees

- Bank’s ownership structure

- Press-center

- Press-center

- News

- Notifications

- Press about us

- Analytical overviews

- Narodniy Bankir

- Promos

- Appeal and safety

- Please, leave a gratitude, complaint or suggestion

- Download the documents

- Archive of files

- Your safety

- Notification of ES-incident

- Financial reports

- Financial reports

- Financial results

- Annual reports

- Performance Indicators

- Financial Institutions

- Correspondent Banking

- Investor relations

- Debt

- Sustainable development

- FUIB during the war

- Key principles

- Report on the progress

- Strategy for sustainable development

- Code of corporate ethics

- Anticorruption Policy

- Labor relations

- Corporate volunteering

- Work with clients

- Business environment

- Use of natural resources

- Risk management

- Supplemental information

- Awards and achievements

- The partners in lending

- Commercial rate

- IBAN standard in Ukraine

- Correspondent Banks

- Membership directory

- Accredited insurance companies

- Information for parties related

- Information on trademarks (TM)

- Settlement of the overdue debt

- Temporary protection of persons in the EU

- General principles of confidentiality and protection of personal data

- General principles of compliance risks monitoring

- General principles of data updating (re-identification)

- Maintenance work

- Maintenance work

*currency exchange only in cash

*exchange rates may be different

in individual branches of the Bank

Commercial rate (for debiting transactions in a currency, which differs from account currency)

- Credit card VSEMOZHU Online<br><span style="font-size:12px">for own and credit funds</span>

- Cash loan VSEYASNO

- Splachuyte chastynamy

- Hroshi v rozstrochku

- Targeted consumer loan

- Online credit

- Credit card VSEMOZHU (till 25.02.2022)

- Deposit Profitable

- Deposit Free

- Deposit Foreign currency

- Deposit Accumulative

- Deposit Guarantee Fund

- Card vseKARTA

- vseKARTA for retirement and social payments

- If you're abroad

- Replenish your card abroad

- Referral programs

- єВідновлення

- For employees of enterprises

- For entrepreneurs

- Money transfers

- Currency exchange

- Order cash currency

- MoneyBox

- Insurance products

- Personal safes

- Cashback and promo codes

- Payment acceptance of individuals

- PUMB mobile application

- Transactions with securities

- Viber-bank in Your pocket

- Depository services

- Google Pay

- Souvenir coins

- Apple Pay

- Encashment

- Swatch Pay

- Payment with escrow account

- Xiaomi Pay

- Mastercard Bilshe program

- Garmin Pay

- Card payment Online

*currency exchange only in cash

*exchange rates may be different

in individual branches of the Bank

Commercial rate (for debiting transactions in a currency, which differs from account currency)

Pay instantly with Google Pay

Choose contactless payments and pay as simply and securely as possible. All you need is just to bring a contactless card, smartphone or gadget with NFC to the terminal and your purchase is paid.

How to start using

Add your card

- Open the settings of the card you want to add to the GPay Wallet

- Add the card to Google Pay by clicking the "Add to GPay" button

- Confirm the usage of the card in Google Pay by clicking the “Continue” button

- Provide consent to the usage of bank payment cards in the mobile payment system by clicking “OK”

- Take a Mastercard or VISA card

- Click "add card"

- Enter the number, month / year of the card and CVC2 code from the back side

- Fill in your billing address

- Click "save"

Pay with your smartphone

- Unlock your smartphone

- Bring your phone to the payment terminal

- Confirmation of successful operation will appear on the screen of your smartphone

-

Enter Google Play and input Google Pay in the search.

Download and install the application on your smartphone. -

Google Pay - an electronic payment system developed by Google. The service allows you to pay for goods and services using a smartphone, tablet or smart watch running on the Android operating system (requires version 4.4 and above, as well as NFC support on the device). When adding a card in the application, a digital analog of the card is created - a virtual account (token).

-

The Google Play Market may notify you that this device does not support this application. When you try to add a card to the application, you may receive a notification that the client has no NFC on the device or that the device is not secure (root access, etc.).

-

Select the item «Add a card».

- Enter the card details (number, validity period and CVV2 - code, which is indicated on the back of the card).

- In the mobile application will be created digital analog of the card - VIRTUAL ACCOUNT or TOKEN.

-

The number of cards that can be added to the application is unlimited.

-

You can connect any card of Mastercard or Visa from FUIB.

The service is temporarily unavailable for Visa Prepaid cards.

-

Google is trying to block 6 UAH to check the card, but even if the blocking is not successful, the card will be added to the application. In case of blocking, the amount will be unlocked within a few minutes.

-

According to the prompts of the application (full name, address, etc.) The data is not checked (for Kyiv it is necessary to select KYIV City in the «Region» line).

-

Any fees/commissions for using Google Pay are not charged.

-

The application works on Android phones version 4.4 and above and have NFC enabled function. Google Pay is not supported on devices with open root-access.

-

NFC (Near Field Communication) – a short-range wireless communication technology (up to 10 cm), allowing contactless data exchange between devices located at short distances: for example, between a reading terminal and a mobile phone or payment card.

-

You can check an NFC adapter in your device using one of these methods:

1. The presence of the NFC logo on your device.

2. The presence of Near Field Communication inscription on the battery of your device.

3. Using the device settings menu:

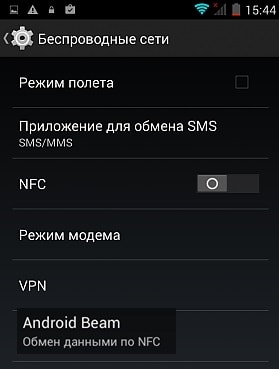

- Enter the settings menu of the Android device – in the «Wireless Networks» section, click «More ...» – you should see the NFC settings item.

-

Terminal must support the contactless payment function (usually, a terminal has the symbol

or Android Pay icon

or Android Pay icon  )

) -

When you use your phone to pay in stores, Google Pay does not send your actual credit or debit card number. Instead, the transaction is carried out through the number of the virtual account (TOKEN) – the digital value that was assigned to your card when it was added to the application. When removing a card, the TOKEN is deleted from the application, if you decide to add the card to the application again; it will be assigned a new TOKEN number. If you add a card to several devices, the TOKEN numbers on different devices will be different. The TOKEN number can work only from the device to which it was installed. Thus, your card data is safe. Data security is guaranteed by the payment systems, cooperating and certified by Google.

-

The card image is set by default and corresponds to the bank settings. The image may differ from the actual design of your physical card.

-

In case of loss theft of your mobile phone, you need to call the call-center by the number (044) 290-7-290, (050) 290-7-290, (068) 290-7-290, (093) 290-7-290 and report it. The call-center employees will block the VIRTUAL ACCOUNT (TOKEN), which is assigned to your card on your mobile device. Remember, that for security reasons, access to the mobile device should always be only using security means (device pin, graphic password, fingerprint verification, etc., means provided by your device). You can continue using the plastic card.

In case there is no possibility to contact the call center of the bank, block the card in any accessible way, it will be impossible to perform transactions on the VIRTUAL ACCOUNT (TOKEN). After locking the TOKEN, you can activate the card and continue using it. -

In point of fact, the Google Pay mobile application is the usual contactless card transaction. The cashier first enters the amount necessary for payment, and only then a card (phone) is applied, data is exchanged, a transaction is made. If you attach a contactless card (phone) to a reader who is not ready to work with it (the second time after making a purchase or simply to the reader without entering the amount of purchase) - the transaction or the second write-off will not happen.

-

You can add to the application cards only of those banks which have been certified for this service. In the application, you can install the cards which will be used by default (always the payment will be made by this card.) To make payment by another card, you need to enter the application and select a card which you would like to pay for the purchase.